Can You Earn Money in Stocks?

The New York Stock Exchange (NYSE) originated on May 17, 1792, when 24 stockbrokers and merchants gathered under a buttonwood tree at 68 Wall Street and signed an agreement. Since then, the stock market has seen immense wealth creation and loss, contributing to the rise of an industrial era dominated by massive corporations considered too essential to fail. While insiders and executives have reaped substantial rewards during this period of significant growth, how have smaller shareholders fared amidst the constant pressures of greed and fear?

The Basics of Stocks

Stocks constitute a significant component of any investor’s investment portfolio. They represent ownership stakes in publicly traded companies that are listed on stock exchanges. The proportion of stocks in your portfolio, the industries you choose to invest in, and the duration you hold onto them are determined by factors such as your age, risk tolerance, and overall investment objectives.

Discount brokers, advisors, and other financial experts often present data demonstrating that stocks have delivered impressive returns over many years. Nonetheless, investing in the wrong stocks can swiftly erode wealth and prevent shareholders from capitalizing on more profitable opportunities.

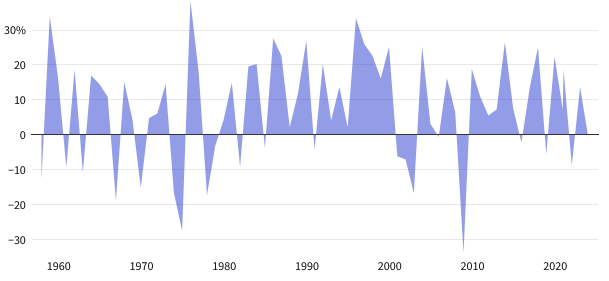

Moreover, relying on those bullet points won’t alleviate the discomfort in your stomach during the next downturn in the market, such as when the Dow Jones Industrial Average (DJIA) plummeted by approximately 50% between October 2007 and March 2009.

Dow Jones Historical Annual Returns

During that time, retirement accounts such as 401(k)s and similar options experienced significant declines, particularly impacting account holders aged 56 to 65. This age group typically sustains the most substantial losses as they approach retirement, often due to maintaining a higher level of investment in equities.

The Employee Benefit Research Institute

The Employee Benefit Research Institute (EBRI) analyzed the 2009 market crash and projected that it might take as long as five years for 401(k) accounts to regain the losses, assuming an average annual return of 5%. However, this offers little comfort considering that individuals may lose years of accumulated wealth and home equity just before retirement, leaving them vulnerable during what should be their most secure years.

That challenging period underscores how temperament and demographics influence stock performance. Greed leads market participants to purchase equities at excessively high prices, while fear prompts them to sell at significant discounts. This emotional swing also creates mismatches between temperament and investment style, as exemplified by uninformed individuals speculating and engaging in trading activities, enticed by the allure of quick and substantial returns.

Making Money in Stocks: The Buy-and-Hold Strategy

The buy-and-hold investment approach gained popularity during the 1990s, supported by the dominance of the “four horsemen of tech” – a group comprising major technology stocks such as Microsoft (MSFT), Intel Corp. (INTC), Cisco Systems (CSCO), and the now privately-held Dell Computer. These companies drove the internet sector to unprecedented heights, leading the Nasdaq to soar. They were considered highly reliable investments, often recommended by financial advisors as long-term holdings. Unfortunately, many individuals who followed this advice entered the market late in the bull cycle. Consequently, when the dotcom bubble burst, the inflated prices of these equities plummeted as well.

Despite encountering setbacks, the buy-and-hold strategy proves fruitful when applied to less volatile stocks, delivering substantial annual returns to investors. It continues to be advised for individual investors who possess the patience to allow their portfolios to flourish, given the historical appreciation of the stock market over extended periods.

The Raymond James and Associates Study

In 2011, Raymond James and Associates conducted a study on the long-term performance of various assets, analyzing the period from 1926 to 2010, spanning 84 years. Throughout this duration, small-cap stocks achieved an average annual return of 12.1%, slightly surpassing the 9.9% return of large-cap stocks. Both categories of assets outperformed government bonds, Treasury bills (T-bills), and inflation, making them highly favorable options for building wealth over a lifetime.

Between 1980 and 2010, equities exhibited robust performance, recording annual returns of 11.4%. However, the real estate investment trust (REIT) equity sub-category outperformed the broader equities category, achieving returns of 12.3%, partly fueled by the real estate bubble driven by the baby boomer generation. This period of outperformance emphasizes the importance of meticulous stock selection within a buy-and-hold strategy, whether through personal expertise or guidance from a reliable third-party advisor.

Between 2001 and 2010, large stocks showed poor performance, yielding only a modest 1.4% return, while small stocks continued to outperform with a 9.6% return. These findings emphasize the importance of diversification within asset classes, necessitating a combination of different capitalization levels and sector exposures. Government bonds also experienced significant growth during this period, although the substantial shift towards safer investments during the 2008 economic downturn may have influenced these figures.

The James study highlights additional typical mistakes related to diversifying equity portfolios. It points out that risk increases significantly when investors do not evenly distribute their investments across different levels of capitalization, growth versus value orientations, and major benchmarks like the Standard & Poor’s (S&P) 500 Index.

Furthermore, achieving the best results involves attaining a balanced mix through diversification across various asset classes, including both stocks and bonds. This approach becomes particularly advantageous during periods of declining equity markets, as it helps mitigate downside risk.

The Importance of Risk and Returns

Profiting in the stock market may seem straightforward, but preserving those gains proves challenging due to factors such as predatory algorithms and internal influences causing sudden fluctuations and reversals, taking advantage of the herd mentality among investors. This contrast underscores the importance of considering annual returns, as investing in stocks becomes illogical if they yield lower profits compared to real estate or a money market account.

Although historical data indicates that stocks have the potential for higher returns compared to other types of securities, achieving long-term profitability necessitates effective risk management and strict adherence to disciplined investment strategies to steer clear of potential pitfalls and occasional anomalies.

Modern Portfolio Theory

The modern portfolio theory offers a crucial framework for understanding risk and managing wealth, regardless of whether you’re a novice investor or have amassed significant funds. Diversification forms the cornerstone of this traditional market strategy, cautioning investors that holding and depending on a single asset class poses a considerably greater risk compared to having a diversified portfolio comprising stocks, bonds, commodities, real estate, and various other types of securities.

It’s essential to acknowledge that risk presents itself in two main forms: systematic and unsystematic. Systematic risk, stemming from factors like wars, economic downturns, and unforeseeable events with potentially significant consequences (referred to as black swan events), leads to a strong correlation among various asset classes, thereby reducing the effectiveness of diversification.

Unsystematic Risk

Unsystematic risk pertains to the inherent peril associated with individual companies failing to meet the expectations of Wall Street or encountering paradigm-shifting incidents, such as the food poisoning outbreak that caused Chipotle Mexican Grill’s stock to plummet by over 400 points from 2015 to 2017.

Numerous individuals and advisors manage unsystematic risk by opting for exchange-traded funds (ETFs) or mutual funds rather than investing in individual stocks. Index investing presents a widely embraced alternative, restricting exposure to prominent benchmarks like the S&P 500, Russell 2000, Nasdaq 100, and others.

Both methods decrease unsystematic risk, yet they don’t eradicate it entirely since apparently unrelated factors can display a strong correlation to market capitalization or sector, leading to ripple effects that affect numerous equities simultaneously. Cross-market and asset class arbitrage can magnify and distort this correlation through rapid algorithms, resulting in various forms of irrational price movements.

Common Mistakes Investor Make

The 2011 Raymond James study revealed a significant underperformance by individual investors compared to the S&P 500 from 1988 to 2008. During this period, the index achieved an annual return of 8.4%, while individual investors only managed a meager 1.9% return.

How to explain this underperformance? Investor missteps bear some of the blame. Some common mistakes include:

Insufficient diversification stands out as a key issue, underscoring the importance of either crafting a carefully balanced portfolio or enlisting the expertise of a proficient investment advisor. Effective risk management involves spreading investments across various asset types and categories within equities. While a skilled individual may occasionally outperform through astute stock or fund selection, achieving consistent results demands significant dedication to research, signal identification, and active management of positions. Even experienced market participants struggle to sustain such intensity over extended periods, making allocation the preferable option in many instances.

In smaller trading and retirement accounts aiming to accumulate substantial equity for genuine wealth management, asset allocation may seem less practical. Instead, opting for targeted and strategic equity exposure could lead to better returns in such scenarios. The majority of capital accumulation often stems from paycheck deductions and employer matching, facilitating account growth.

Focusing solely on equities carries significant risks, as individuals might become impatient and make the second most harmful error: attempting to time the market.

Professional market timers dedicate decades to honing their skills, spending countless hours observing market activity, and recognizing recurrent behavioral patterns that enable profitable entry and exit strategies. They grasp the cyclical nature of the market and know how to exploit the herd mentality driven by greed or fear. This approach starkly contrasts with the actions of casual investors who may lack a deep understanding of market cycles. As a result, their efforts to time the market could undermine long-term returns, potentially eroding investor confidence.

Emotional bias frequently influences investors, leading them to develop strong attachments to the companies they invest in. This can result in them taking larger positions than necessary and overlooking negative indicators. Despite the allure of impressive investment returns from companies like Apple and Amazon, it’s important to recognize that paradigm-shifting opportunities like these are rare occurrences.

A prudent approach to stock ownership is essential, rather than adopting a high-risk, speculative strategy. This can be challenging, especially with the internet often hyping up the latest trends, leading investors to become overly enthusiastic about stocks that may not warrant such excitement.

Know the Difference: Trading vs. Investing

Employer-sponsored retirement plans like 401(k) programs encourage a long-term approach to investing, emphasizing buy-and-hold strategies where asset allocation adjustments are usually made annually. This structure helps deter impulsive decisions. Over time, as portfolios expand and new employment opportunities arise, investors accumulate more funds to explore self-directed brokerage accounts, utilize self-directed rollover individual retirement accounts (IRAs), or entrust their investments to trusted advisors capable of actively managing their assets.

Conversely, the prospect of having more investment capital may tempt certain investors to venture into the exhilarating realm of short-term speculative trading. They might be drawn by stories of day trading successes, where individuals profit handsomely from technical price fluctuations. However, in truth, these unconventional trading practices often result in greater overall losses than significant gains.

Similar to market timing, achieving profitability in day trading demands a level of dedication that’s nearly unattainable for individuals employed outside the financial services sector. Professionals within the industry approach their craft with meticulous attention, akin to how a surgeon approaches surgery, meticulously monitoring every dollar and its response to market dynamics. Having experienced their fair share of losses, they understand the significant risks involved and possess the skill to skillfully navigate predatory algorithms while disregarding unreliable tips from questionable market sources.

Studies That Analyze Day Trading

In 2000, a study conducted by the University of California, Davis, and published in The Journal of Finance examined prevalent misconceptions associated with active stock trading. Through a survey of over 60,000 households, the researchers discovered that active trading yielded an average annual return of 11.4% between 1991 and 1996. This figure was notably lower than the 17.9% returns achieved by major benchmarks during the same timeframe. Furthermore, their analysis revealed a negative correlation between returns and the frequency of stock transactions.

The research also found that a preference for small, high-beta stocks, combined with excessive confidence, often resulted in lower performance and increased trading activity. This reinforces the idea that high-risk investors mistakenly believe their short-term strategies will succeed. Such an approach contrasts with the prudent investment strategy of experienced investors, who analyze long-term market trends to make more informed and deliberate investment choices.

In a study conducted in 2015, authors Xiaohui Gao and Tse-Chun Lin presented intriguing findings suggesting that individual investors perceive trading and gambling as analogous activities. They observed an inverse relationship between trading volume on the Taiwan Stock Exchange and the magnitude of the country’s lottery jackpot. These results align with the behavior of traders who engage in short-term speculation driven by the thrill of capturing quick gains, similar to the excitement associated with winning a large prize.

Curiously, the feeling of excitement associated with losing bets is comparable to that of winning, which can lead to self-destructive behavior. This tendency explains why these investors frequently increase their wagers on unsuccessful bets. However, their aspirations to recoup their losses rarely materialize.

Finances, Lifestyle, and Psychology

Successful stock ownership relies on closely matching an individual’s financial situation. New entrants to the workforce often have limited choices for asset allocation in their 401(k) plans. Typically, they are constrained to investing in a handful of established blue-chip companies and fixed-income options that promise consistent long-term growth.

Conversely, individuals approaching retirement may have amassed considerable wealth but may lack sufficient time to gradually build returns. Trusted advisors can assist these individuals in actively managing their assets in a more assertive manner. However, some individuals opt to grow their growing nest eggs through self-directed investment accounts.

Younger investors may lose money by haphazardly trying out various investment strategies without mastering any of them. Similarly, older investors who choose to manage their own investments also face the risk of making mistakes. Therefore, seasoned investment professionals have the greatest potential for growing portfolios.

It’s crucial to address personal health and discipline concerns before adopting an active investment approach because markets often mirror real-life situations. Individuals who are unhealthy, physically unfit, and suffer from low self-esteem might gravitate towards short-term speculative trading as they may subconsciously feel undeserving of financial success. Engaging in risky trading behaviors that are likely to result in negative outcomes could be a form of self-sabotage.

The Ostrich Effect

In 2006, a study featured in the Journal of Business introduced the concept of the “ostrich effect.” It refers to investors exhibiting selective attention regarding their stock and market exposure, as they tend to monitor their portfolios more often during periods of market growth and less frequently, or even ignore them completely, during market downturns (similar to “putting their heads in the sand”).

The study also explained how these behaviors impact trading volume and market liquidity. Trading volumes typically rise during periods of market growth and decline during market downturns, contributing to the tendency for participants to follow upward trends while ignoring downward ones. Once again, excessive confidence may be the motivating factor, as participants increase their exposure to the market due to the confirmation of a pre-existing positive bias by the rising market.

The decrease in market liquidity during downturns aligns with the study’s findings, suggesting that “investors tend to temporarily disregard the market during downturns to avoid facing the mental distress caused by significant losses.” This counterproductive behavior is also evident in routine risk management practices, explaining why investors frequently sell their successful investments prematurely while allowing their losing investments to persist—the exact opposite strategy needed for long-term profitability.

Panic-Inducing Situations

Wall Street appreciates statistics that highlight the advantages of long-term stock ownership, a fact easily demonstrated by examining a 100-year Dow Industrial Average chart, particularly when viewed on a logarithmic scale that mitigates the visual impact of four significant market downturns.

The 84-year period analyzed in the Raymond James study experienced at least three market crashes, providing more accurate metrics compared to selectively chosen data commonly found in the industry.

Alarmingly, three severe bear markets have occurred in the last 31 years, falling within the investment timeline of today’s baby boomers. In addition to these significant downturns, stock markets have experienced numerous minor crashes, declines, and other unexpected events, known as outliers, which have challenged the resilience of stock investors.

It may be tempting to underestimate the significance of those steep declines, especially since they appear to validate the strategy of buying and holding investments. However, psychological vulnerabilities discussed earlier often emerge when markets begin to decline. Many typically rational investors hastily sell off their long-term holdings during these downturns, eager to alleviate the emotional distress of witnessing their retirement savings rapidly diminish.

Ironically, the market downturn comes to an end when a sufficient number of these individuals sell off their holdings, presenting opportunities for bottom fishing by those who have incurred minimal losses or for winners who have placed short sale bets to capitalize on reduced prices.

Black Swans and Outliers

Nassim Taleb introduced the concept of a black swan event, which refers to an unpredictable occurrence that deviates significantly from what is typically anticipated and can result in severe consequences. In his 2010 book “The Black Swan: The Impact of the Highly Improbable,” Taleb outlines three characteristics of a black swan:

- It is an outlier, falling beyond the realm of normal expectations.

- It has a profound and often destructive impact.

- Following the event, human nature tends to rationalize it, making it seem explainable and predictable.

Given the third attitude, it’s easy to understand why Wall Street never discusses a black swan’s negative effect on stock portfolios.

Shareholders should prepare for black swan events during normal market conditions by practicing the steps they would take when faced with such a situation. This process is akin to conducting a fire drill, where individuals familiarize themselves with the location of exit routes and other escape options if necessary. Additionally, they must objectively assess their capacity to endure discomfort, as it is pointless to devise an action plan if it will be abandoned during the next market downturn.

While Wall Street may advocate for investors to remain passive during challenging periods, ultimately, the decision to act lies solely with the shareholder, as it can significantly impact their life.

How Do Beginners Make Money in the Stock Market?

Novice investors can generate profits in the stock market by:

1. Starting early—leveraging the power of compounding, where earnings generate further earnings over time. Even modest initial investments can grow significantly when left to accumulate.

2. Adopting a long-term mindset—the stock market experiences fluctuations, but historically, it has shown appreciation over extended periods. Having a distant investment horizon helps mitigate the impact of short-term market volatility.

3. Consistency is key—maintain a disciplined approach to investing. Take advantage of employer-sponsored plans like a 401(k), if available, which automatically deducts a portion of your paycheck for investment in selected funds. Alternatively, consider dollar-cost averaging, investing fixed amounts at regular intervals in specific assets, regardless of their current price.

4. Depending on professionals—avoid attempting to select individual stocks independently. Financial experts specialize in “money management,” and when you invest in a mutual fund, ETF, or another managed fund, you’re leveraging their knowledge, skills, and analysis. In essence, entrust the task of investing to them. Investing in funds also offers the benefit of diversification—their portfolios typically include dozens, if not hundreds, of individual stocks—thus reducing risk.

Can You Make a Lot of Money in Stocks?

Yes, as long as your objectives are reasonable. While you may hear stories of individuals making significant profits from stocks that double, triple, or quadruple in price, such occurrences are infrequent and often associated with day traders or institutional investors involved in taking a company public.

For individual investors, it’s more practical to set expectations based on the historical performance of the stock market over specific time frames. For instance, as of December 2023, the S&P 500 Index (SPX), widely regarded as a benchmark for the U.S. stock market, has delivered returns of 13.72% over the past five years and 10.17% over the past ten years. Since 1990, its value (as of December 19, 2023) has surged more than fourteen times, rising from 329 to 4,768.

What Are Three Ways to Make Money in the Stock Market?

There are three methods to generate profits in the stock market:

1. Selling stock shares at a profit—This involves selling shares at a higher price than the purchase price, following the traditional strategy of “buying low, selling high.”

2. Short-selling—This strategy operates in reverse to the traditional approach mentioned above, often referred to as “selling high, buying low.” In short-selling, shares of stock are borrowed (usually from a broker), sold on the market, and repurchased later at a potentially lower price. Once the shares are returned to the lender, any profit is retained. Short-selling is essentially a wager on the decline in a stock’s value.

3. Receiving dividends—Many stocks distribute dividends, which are portions of the company’s profits per share. Typically distributed quarterly, dividends serve as an additional reward for shareholders, commonly paid in cash but occasionally in additional shares of stock.

How Do You Take Profits From Stocks?

The primary objective of every investor is to profit from their stocks. However, determining the opportune moment to cash out and realize those gains, thereby securing profits, is a critical decision, and there isn’t a universally correct answer. Much depends on an investor’s willingness to take risks and their investment horizon—how long they can afford to wait for the stock to appreciate compared to their desired level of profit.

Avoiding greed is essential. Some financial experts suggest considering taking profits once a stock has appreciated approximately 20% to 25% in value, even if it appears to still be on an upward trajectory. “The key is to exit the elevator at one of the floors on the way up and not ride it back down again,” as stated by Investor’s Business Daily founder William O’Neil.

Other financial advisors employ a more intricate guideline, which entails incremental profit-taking. For instance, Jeffrey Hirsch, the chief market strategist at Probabilities Fund Management and editor-in-chief of The Stock Market Almanac, follows a “up 40%, sell 20%” strategy: When a stock increases by 40%, sell off 20% of the holding; and as it rises another 40%, sell another 20%, and so forth.

The Bottom Line

Certainly, stocks can yield profits and pave the way for lifelong prosperity, yet prospective investors must navigate a series of economic, structural, and psychological hurdles. The most dependable route to sustained profitability typically begins modestly, involving the selection of a suitable stockbroker and initially concentrating on wealth accumulation, with scope for exploring additional opportunities as capital increases.

For the majority of market participants, buy-and-hold investing represents the most resilient approach. However, a minority who excel in specialized techniques may achieve enhanced returns through various strategies, including short-term speculation and short selling.

Trade on the Go. Anywhere, Anytime

A major cryptocurrency exchange is open for business, offering competitive fees and personalized customer assistance for secure trading. Access a range of Binance tools designed to simplify trade tracking, auto-investments management, price chart viewing, and fee-free conversions. Sign up for free to join millions of traders and investors worldwide in the dynamic crypto market.